Impressive Tips About How To Build Your Credit After Bankruptcy

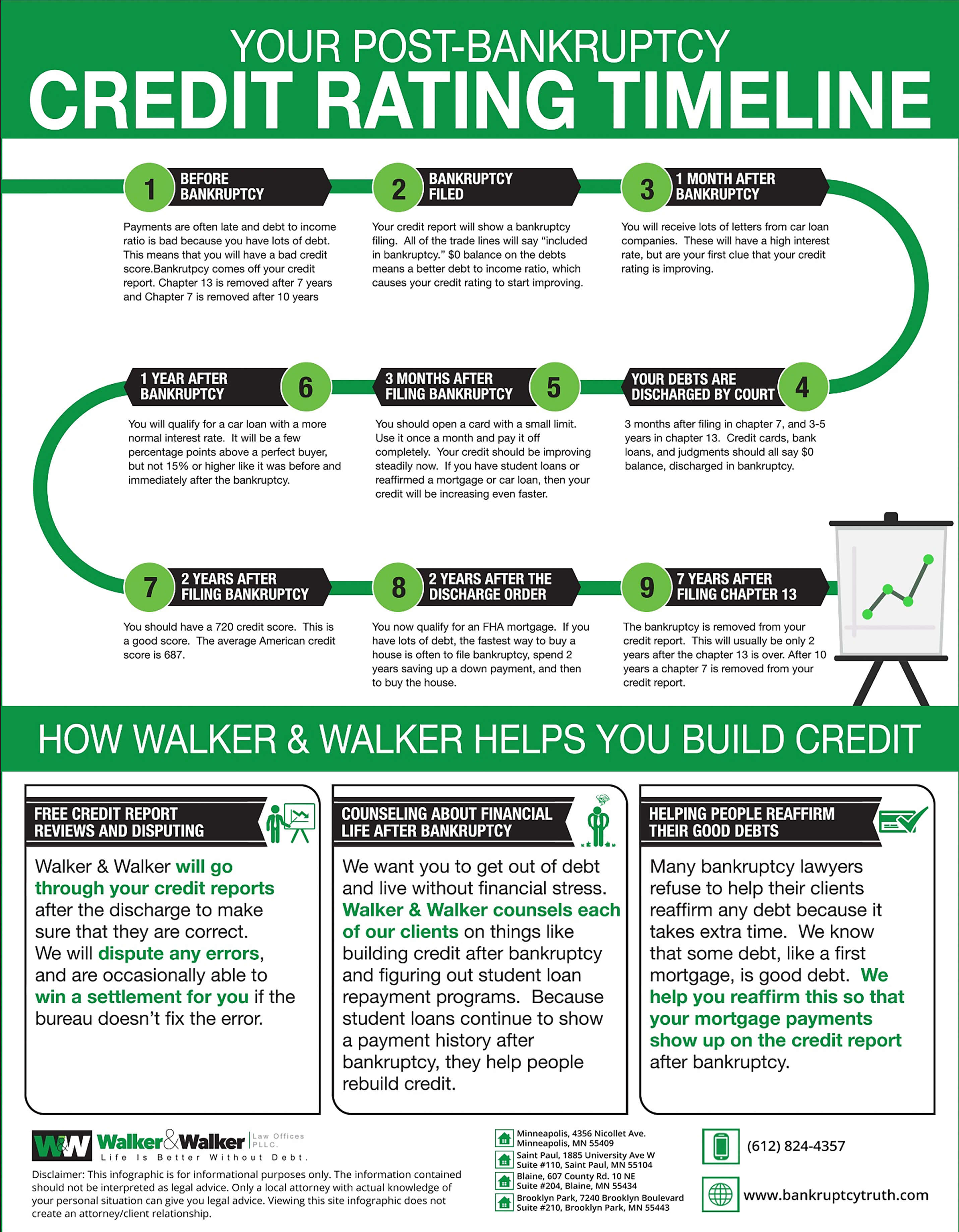

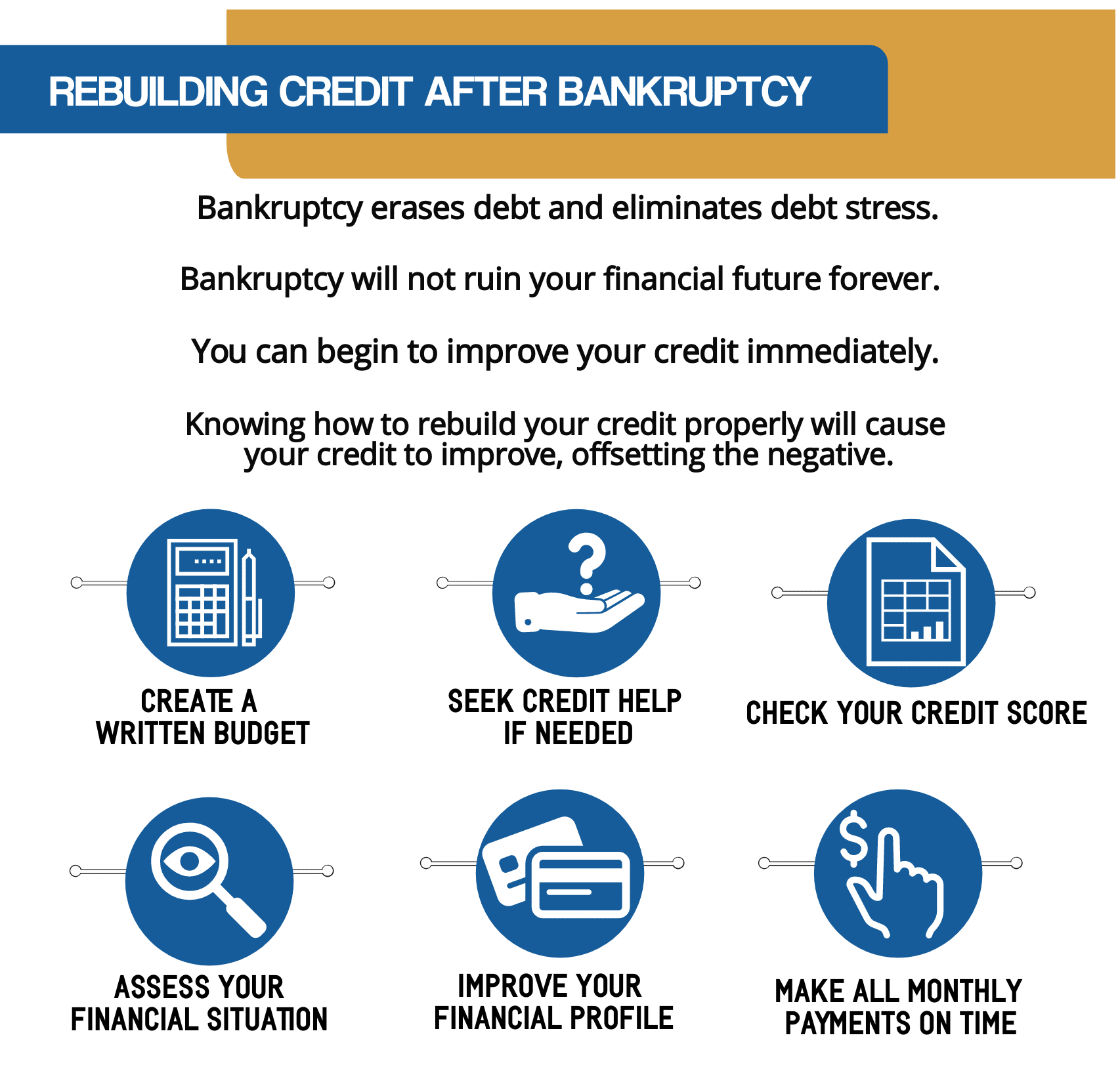

Once you’ve completed your bankruptcy, here are the basic steps to building your credit:

How to build your credit after bankruptcy. Car loans are the first type of loan you can get after bankruptcy. How to build credit after bankruptcy review your credit report. Visit annualcreditreport.com and request your credit report from the three credit bureaus:.

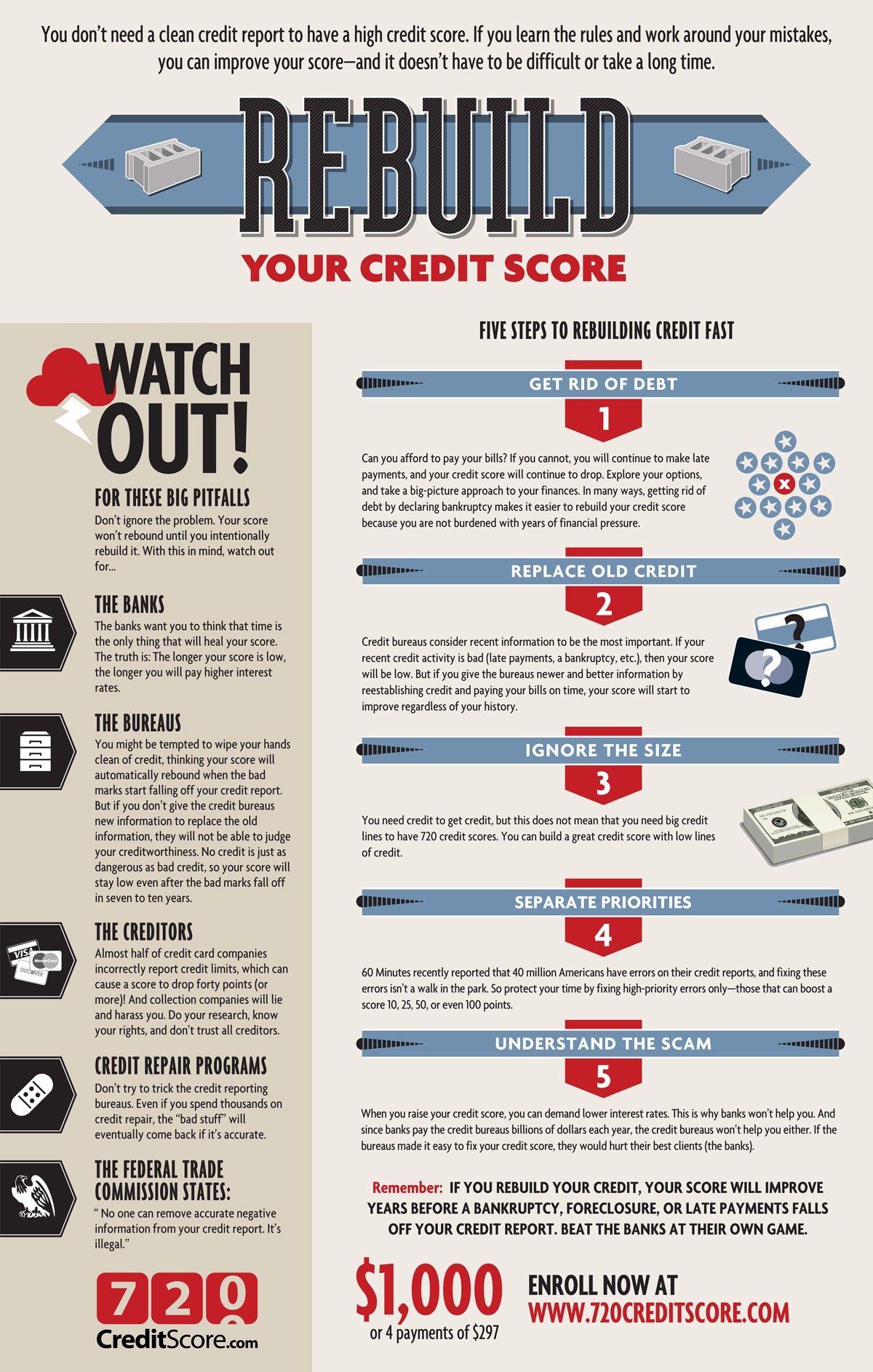

Our certified debt specialists help you achieve financial freedom faster. You can build credit after bankruptcy by making wise financial decisions. Rebuilding your credit after filing for bankruptcy can seem daunting, but there are some steps you can take to help your credit.

After bankruptcy, your credit can take a big dig. Ad one low monthly payment. Rebuilding credit after chapter 7, how long after bankruptcy does credit improve, get a credit card after bankruptcy, how to repair your credit after bankruptcy, building credit after bankruptcy.

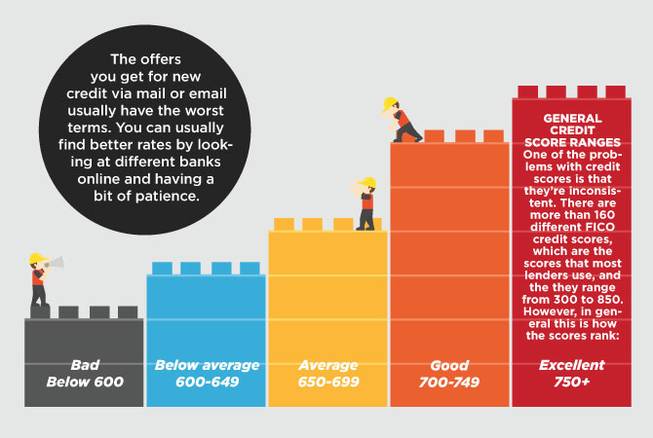

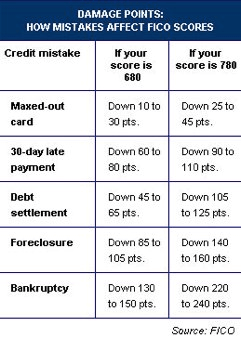

In simple words, filing bankruptcy comes with a negative credit score that can impact your financial loan. Ad responsible card use may help you build up fair or average credit. It may be harder for people who have filed for bankruptcy to get approved for a loan or obtain the interest rate they want, but new credit is actually one of.

This means most (or all) of your accounts will be at a zero balance, and creditors must stop calling you about. New credit scores take effect immediately. Like a secured credit card, it’s a secured method of building credit.

Check credit reports to ensure that there is no information that is inaccurate or remained on your credit report after filing for bankruptcy. First, you must make sure there are no unpaid debts or items in collections that. Paying off the full credit.