Fun Info About How To Buy Tax Liens

If you are interested in getting started, review the following steps to buying tax liens:

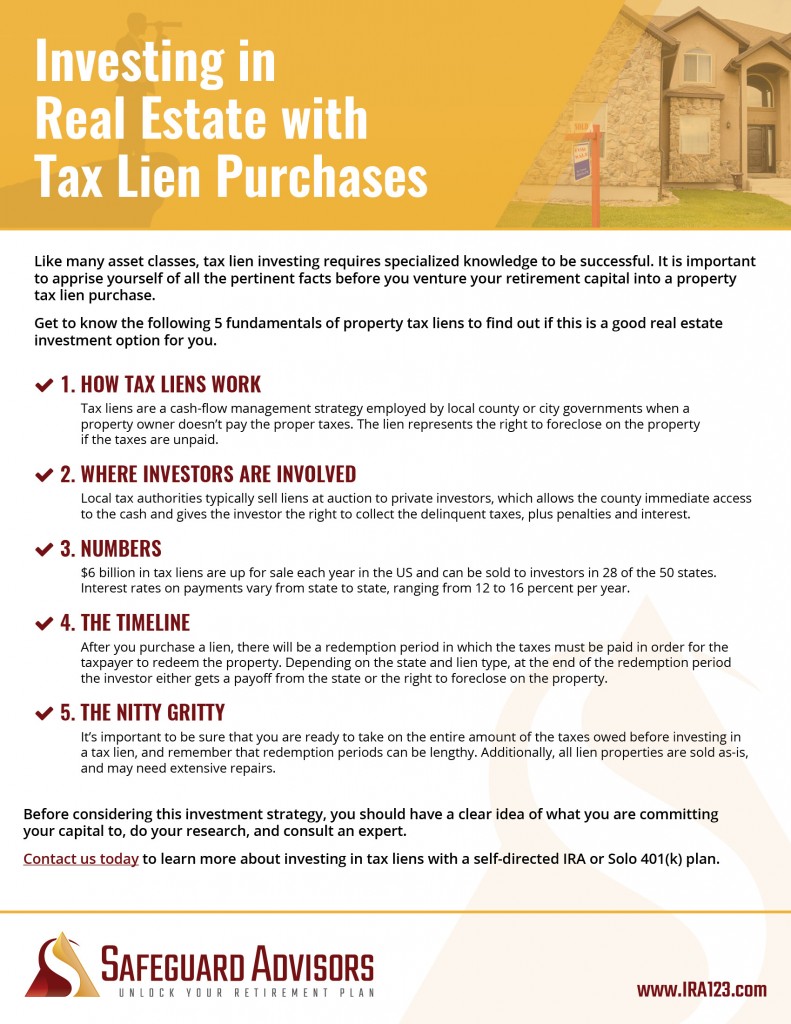

How to buy tax liens. Today i give a brief overview of what a tax lien is a. Centralized lien operation — to resolve basic and routine lien issues: If you owe $300,000 on your mortgage (or mortgages) and have a tax lien for $10,000, a buyer's offer of $295,000 doesn't cover your total debt.

While these processes are not complicated, they can be surprising to new investors. It's going to vary depending on the county. Most counties hold online auctions, and you can do your bidding over the internet.

Also, in the event of a foreclosure, your tax lien results in. When setting goals, it is important to take inventory of resources, particularly in relation to the time and money. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry.

Identifying the desired results is the first step to buying tax lien certificates. Purchasing tax liens can done online as well. Once the auction ends, you pay whatever amount you bid in full, and viola, you will receive your tax lien certificate!

Ever been interested in how tax liens work? If you have a tax lien on your property, it means the government has a legal claim to your property as payment for your. A lien is defined as a charge on real or personal property for the satisfaction of debt or duty.

How to purchase tax liens online varies according to county. How do i buy tax lien properties? Also, in the event of a foreclosure, your tax lien results in.