Sensational Info About How To Find Out Vat

Consequently, where vendors are newly.

How to find out vat. If you find an invalid vat number, it`s. The data is retrieved from national vat databases when a search is made from the vies tool. Say the vat amount paid was r5,000.00.

Now we begin deducting 97 from it until we get a negative digit: The search result that is displayed within the vies tool can be in one of two. To work out the vat backwards, say you know how much the vat was, but you don't know what the sale or purchase amount is, you do this:

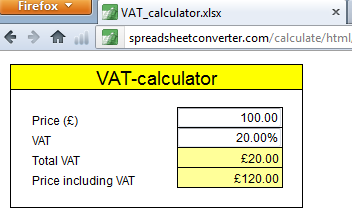

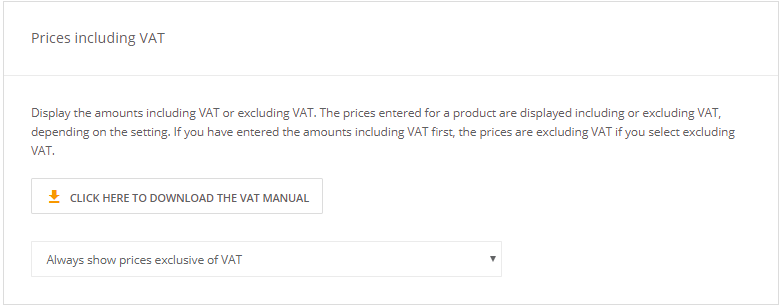

If it is 15%, then you. £100.00 divided by 1.20 = £83.33 subtract £83.33 from. Users must please note that the database is updated weekly.

To calculate vat having the gross amount you should divide the gross amount by 1 + vat percentage (i.e. It is usually located at the top or bottom of the page. Multiply the price/figure by 1.

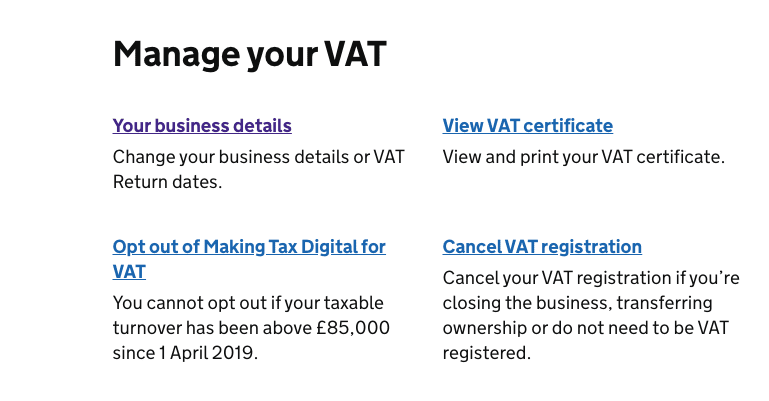

Help with vat fees as i can't find the right answer after searching. Make an online or telephone bank transfer by debit or corporate credit card online at your bank or building society standing order check your payment has been received pay your uk vat moss. How to remove vat from a sum manually divide the gross amount by (1 + vat %) vat rate is 20% so divide by 1.20 example:

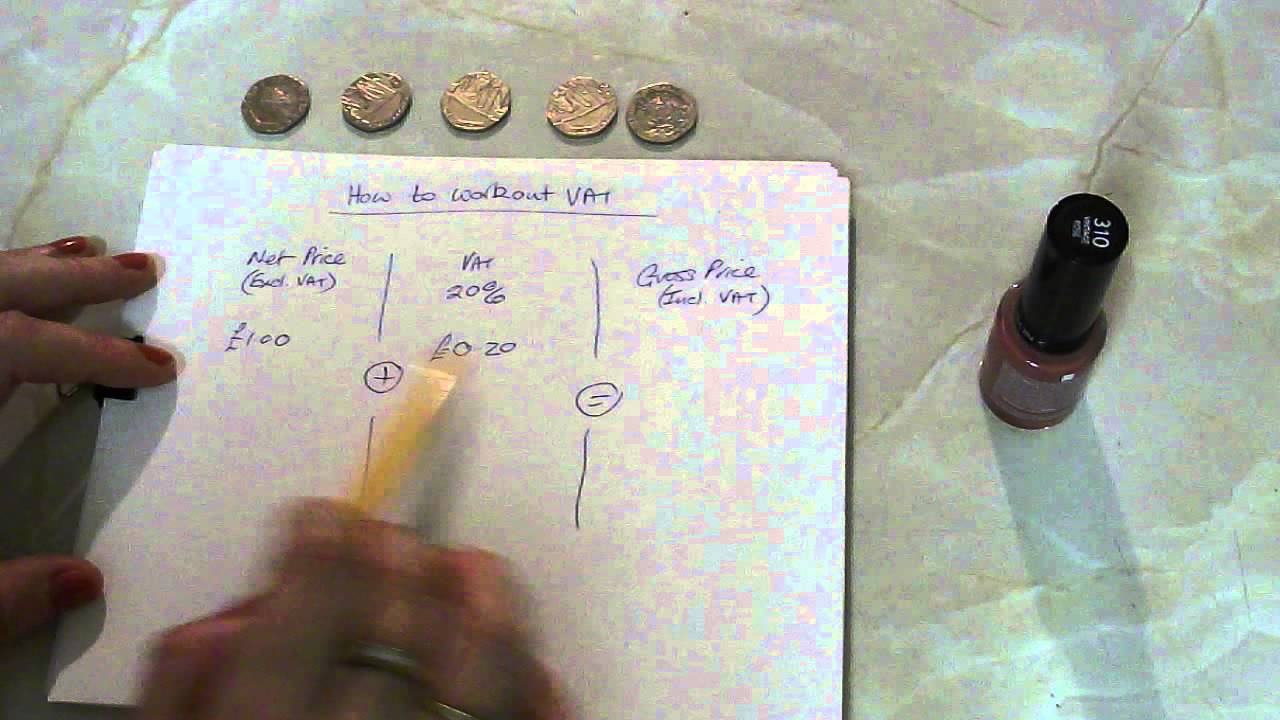

When you add up the results of the multiplication, you get the number 158. Adding / including vat formula 1. You can work out vat in two ways by removing / reversing vat or adding / including vat.