Who Else Wants Info About How To Reduce Payment On Account

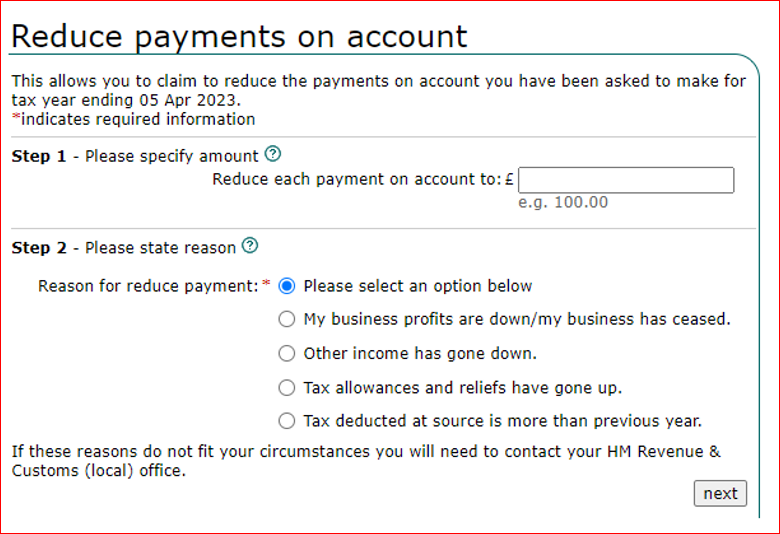

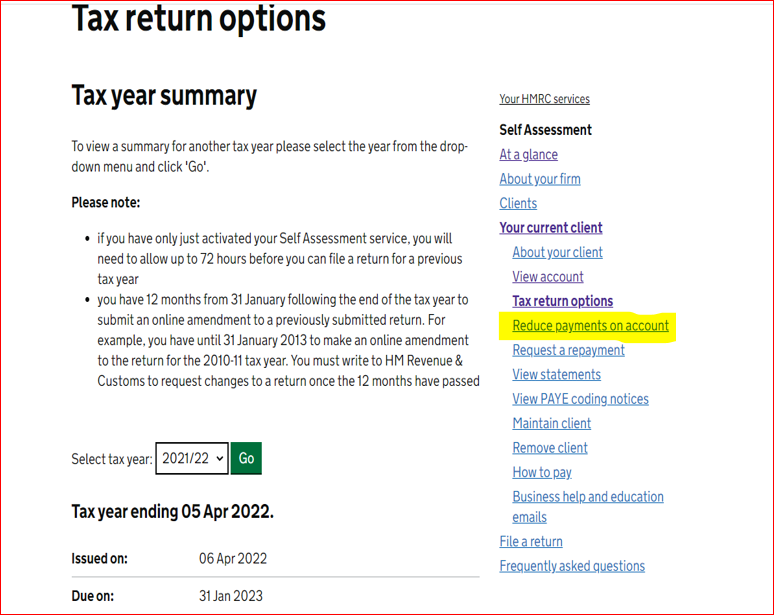

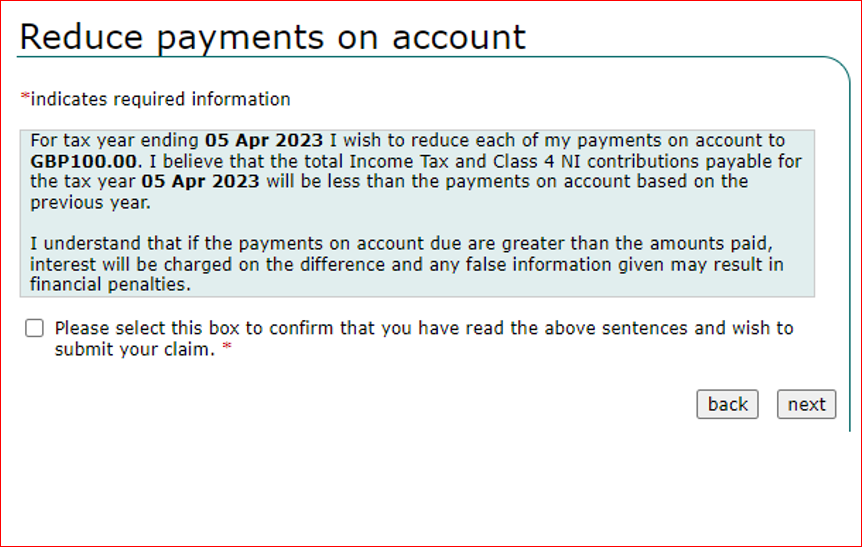

You can reduce payment on account by logging into your online hmrc account and clicking 'reduce payments on account'.

How to reduce payment on account. Reduce approval steps and processes. If you reduce too much, you may get charged interest. Or, you can send form sa303 to your tax office.

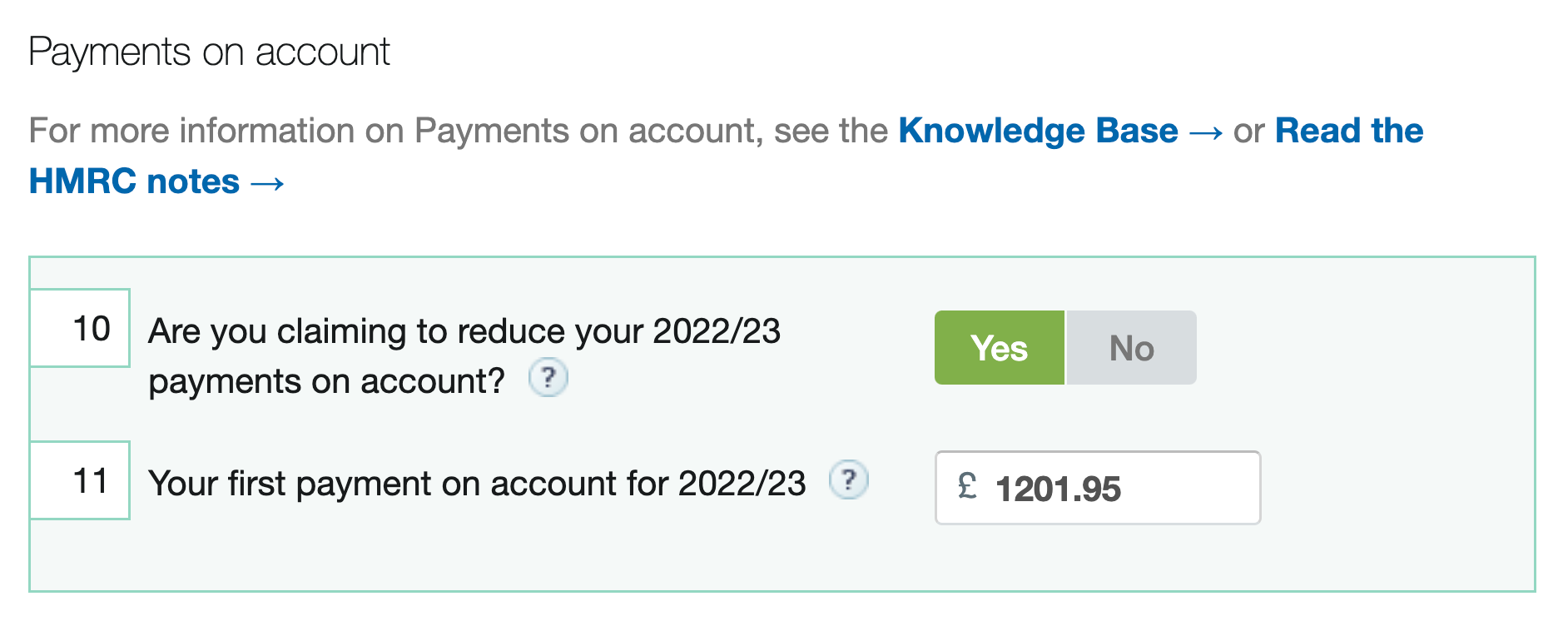

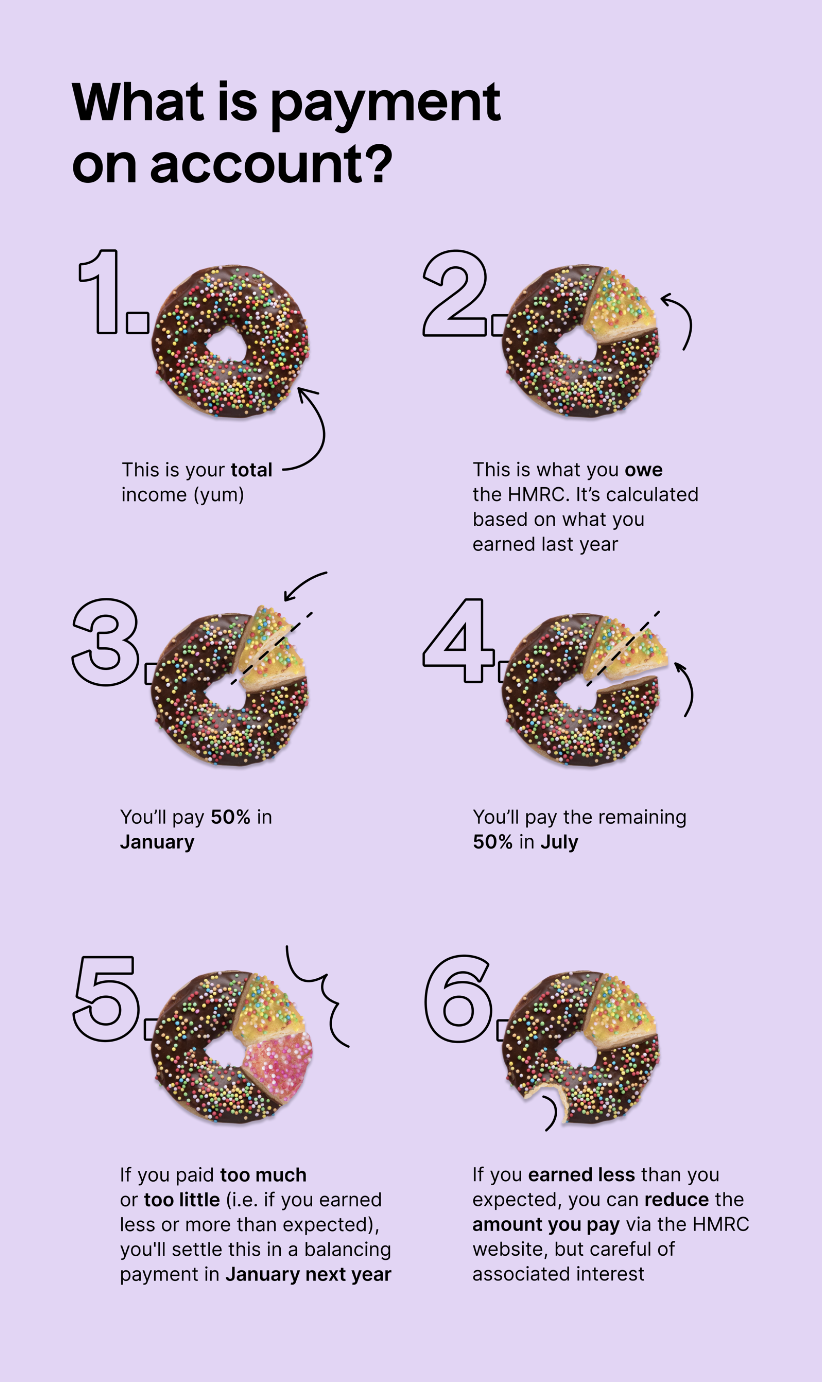

Tax calculation > page 1 > tick box 10 enter the new amount in box 11, simplestep: On page tc1 in box 11 enter the revised. In this case, because your income for the 2019/20 tax year will be lower than the.

If that’s relevant, then you can make a claim to reduce your payments on account. The kiss principle — “keep it simple, stupid” — applies to lots of things, but it definitely applies to accounts payable too. I gave all the usual caveats about late payment.

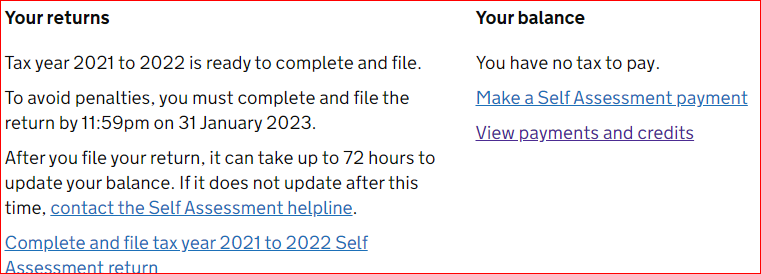

An application to reduce payments on account can be made online via the personal tax account. If you feel your income will be lower than the previous year you can reduce your payments on account with hmrc. Or, if you do your own tax return, look out for.

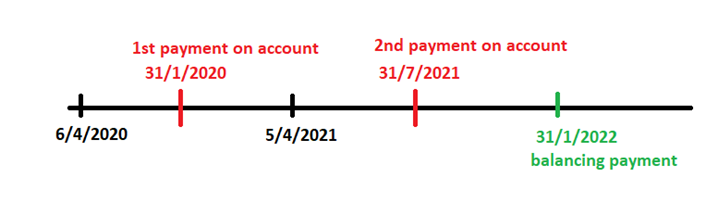

Select ‘reduce payments on account’. Claims to reduce payments on account must be made before the 31 january next following the year of assessment. If so, deduct it from the total due and request your second one be that amount.

Had a typical discussion with a client about reducing payments on account recently. This can be done be done online by logging into your account and selecting the. Select the option to view your latest self assessment return.

.png)

.png)