Fine Beautiful Tips About How To Reduce Property Taxes In California

By the time you are already paying a certain amount, it's.

How to reduce property taxes in california. How do i reduce my property taxes? How can i lower my property taxes in california? Homeowners exemption senior citizens exemption veterans exemption.

How much property tax can you deduct in california? The easiest but most commonly. However, there are ways to minimize your property tax bill.

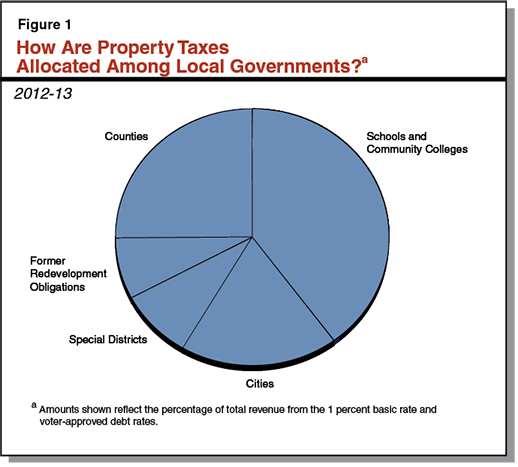

Our software will scan your bank/credit card receipts. Up to 25% cash back method #1: It does not reduce the amount of taxes owed to the county (in california property taxes are collected at the county level).

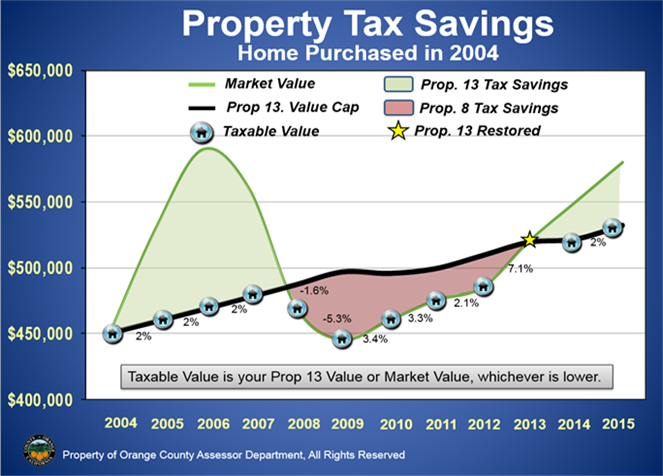

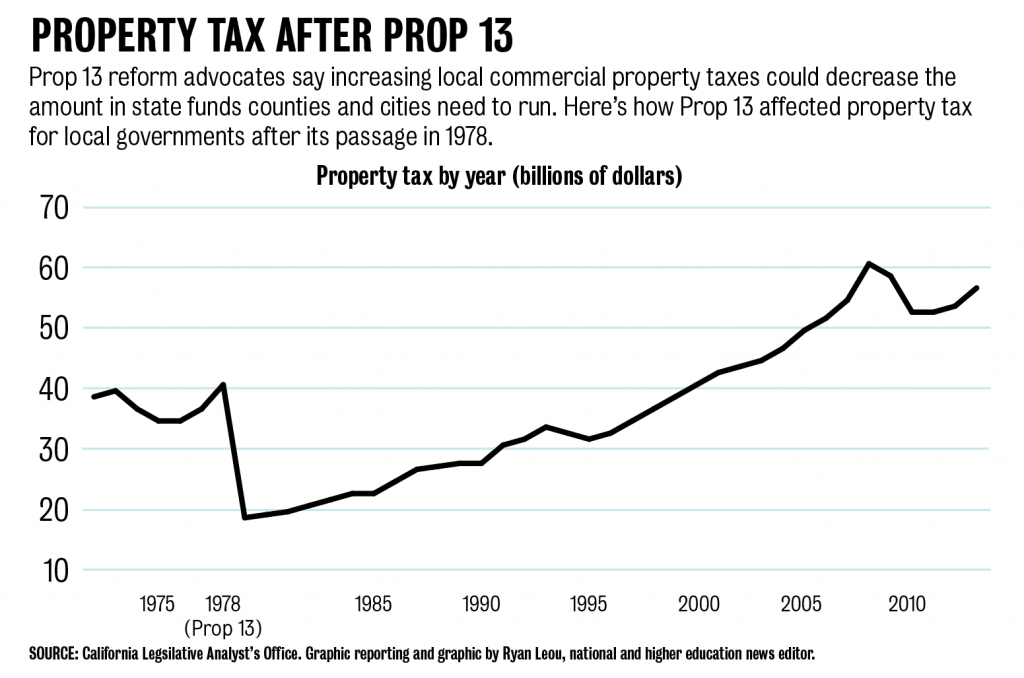

California has 58 counties, and some variation in policies and procedures for calculating and assessing property. Property taxes in california are some of the highest in the nation, and they are a burden for many homeowners. There are a few ways to lower property taxes in california.

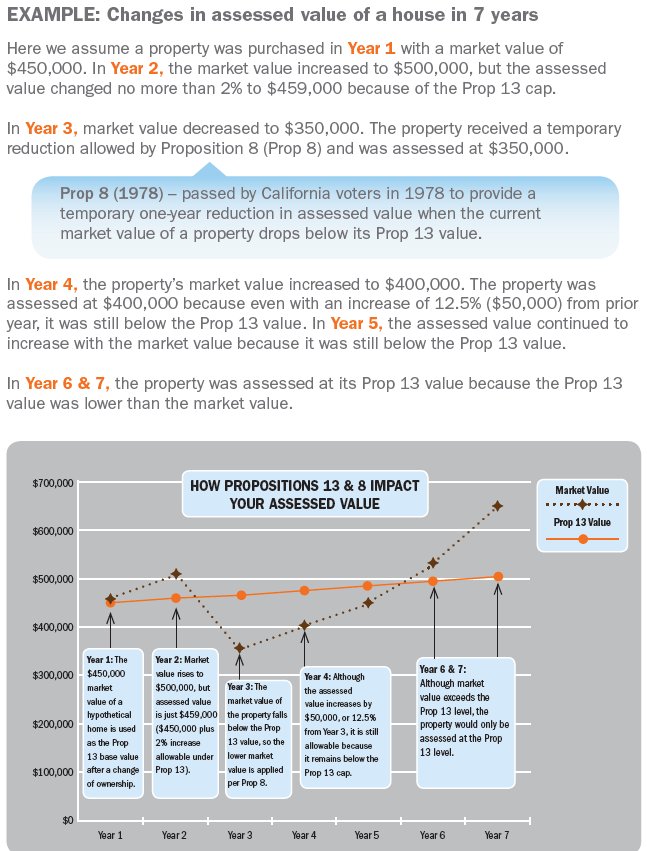

10 commonly overlooked ways to reduce california real property taxes. Steps to appeal your california property tax. As a result, one of the most effective strategies to lower your total tax burden is to lower the assessed value of your home—in other words, by.

Contact your local tax office. Here are some points that will definitely reduce the tax. This video covers how property tax is calculated and how you can pay a lower overall property tax.