Smart Info About How To Apply For A Non Profit Tax Id Number

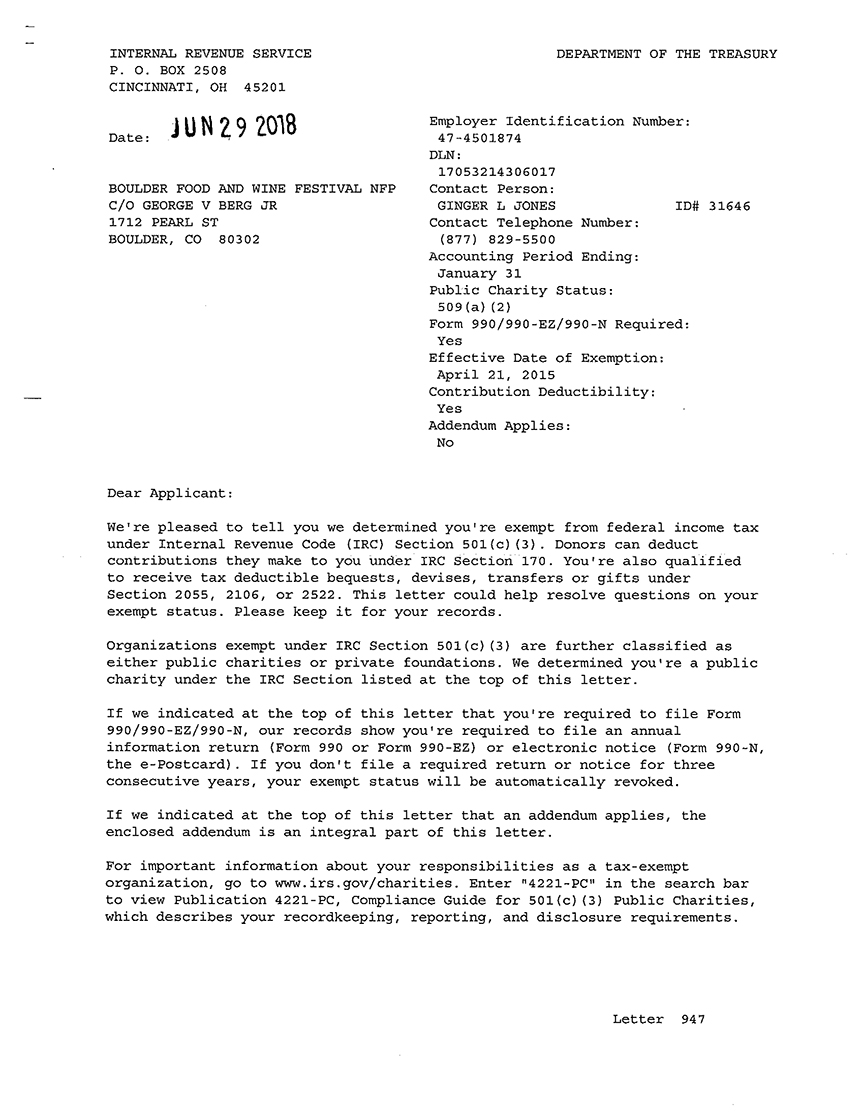

We allegedly have a ein number, but it is not coming up in any irs searches.

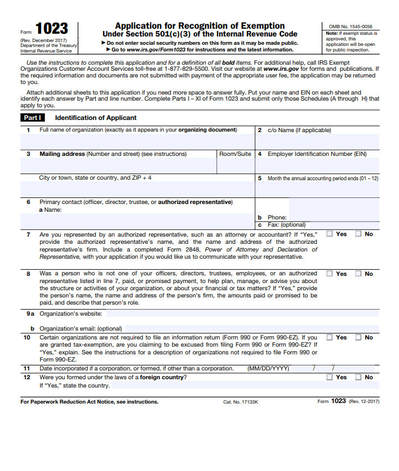

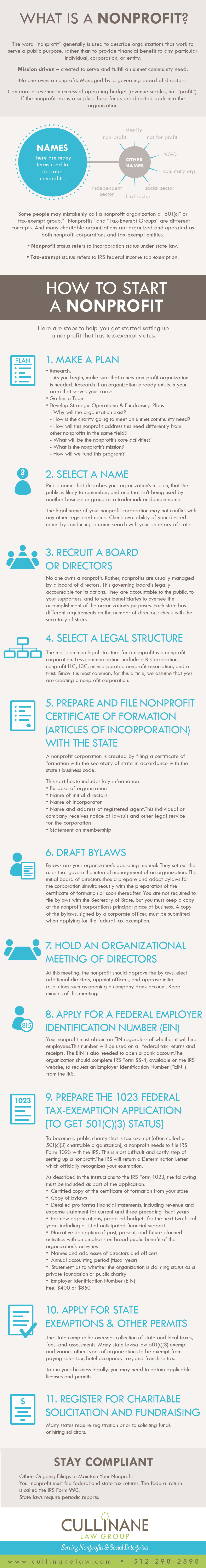

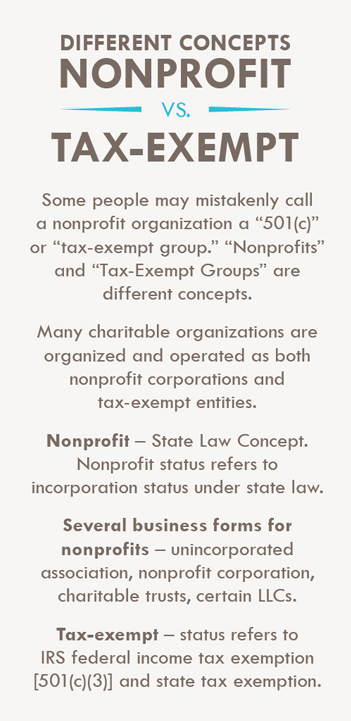

How to apply for a non profit tax id number. Applications for nonprofit status must be submitted online to. How to apply for a nonprofit tax id. The ein, or employer identification number, is also known as a federal tax identification number (tin), and is used to identify a business or nonprofit entity.

For example, an ein should not be used in tax lien auction or sales, lotteries, or for any other purposes not related to tax administration. The method is fairly straightforward and there are no fees to apply for an ein number. An employer identification number , also.

There are just a few key activities. Applying online is the easiest and preferred method. On the application, it is imperative to.

Form 1023 part i, identification of applicant;. When determining the nonprofit status of an organization, begin by using the irs select check. International applicants may apply by phone.

Within the united states, you should find the 501 (c) (3) tax code. Using the online assistant is the easiest way to apply. Govt assist, llc offers a paid service in which its employees or agents will prepare and submit your employer identification number application (“ein application”) to the irs on your behalf.

Employer identification number (ein) get an. Matt is getting ready to apply for. Nonprofit board of directors, officers & members;