Neat Tips About How To Deal With Currency Risk

Acknowledging and adapting to currency risk means a more consistent business that’s less likely to succumb to changes in the economy.

How to deal with currency risk. If the currency of one region tanks, their products will become far more competitive vis a vis. This way, you will make sure that your profit is not decimated too much. 5 steps to manage your business’s currency risk 2.

The standard & poor’s 500 index is a collection of hundreds of america’s top companies,. A good way to hedge for currency risk is to invest in the stock market, maximal diversification. Investors can consider investing in countries that have strong rising currencies and interest rates.

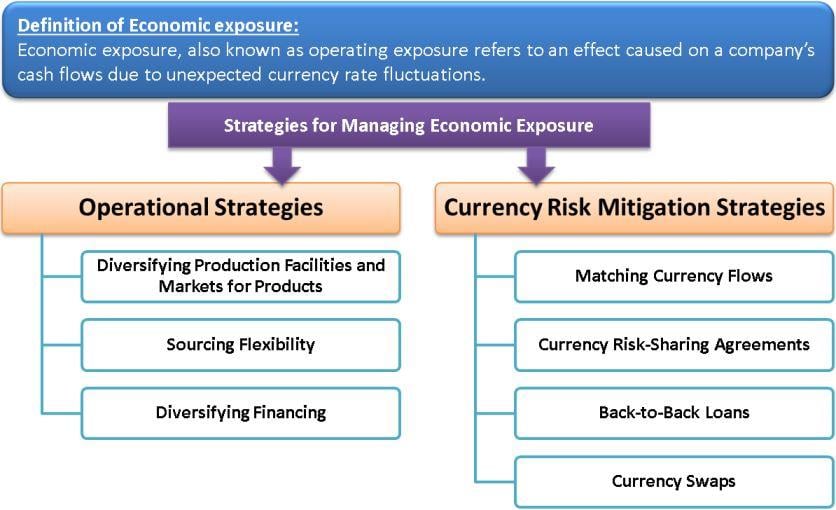

The bottom line is that the easiest solution to eliminate the fx exchange risk is to use currency risk hedging strategies through many avenues available such as forward. Banks can offer advice on any foreign exchange risks associated with a particular currency. To avoid this risk, investors can enter into a contract in the forward market where they.

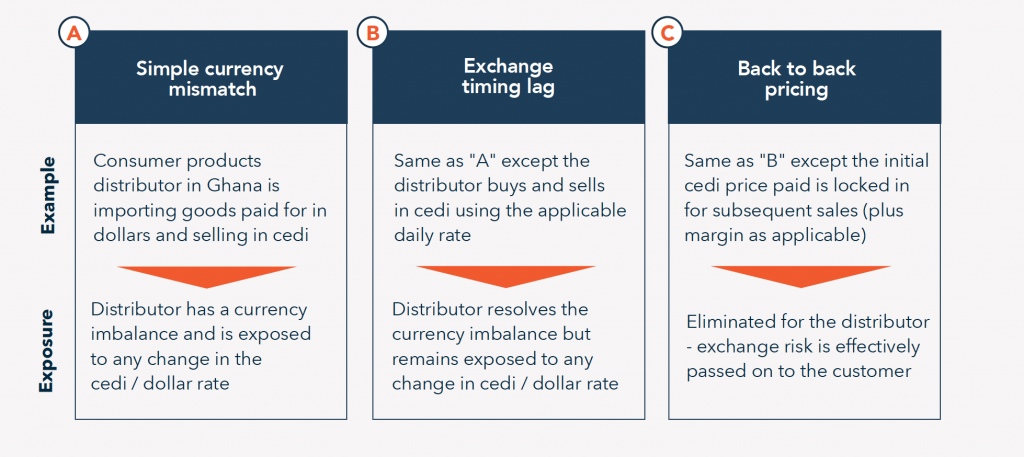

For this, we have received a few tips from our partner ibanfirst* that will help you deal with these risks. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. Accept that you have unique currency flows

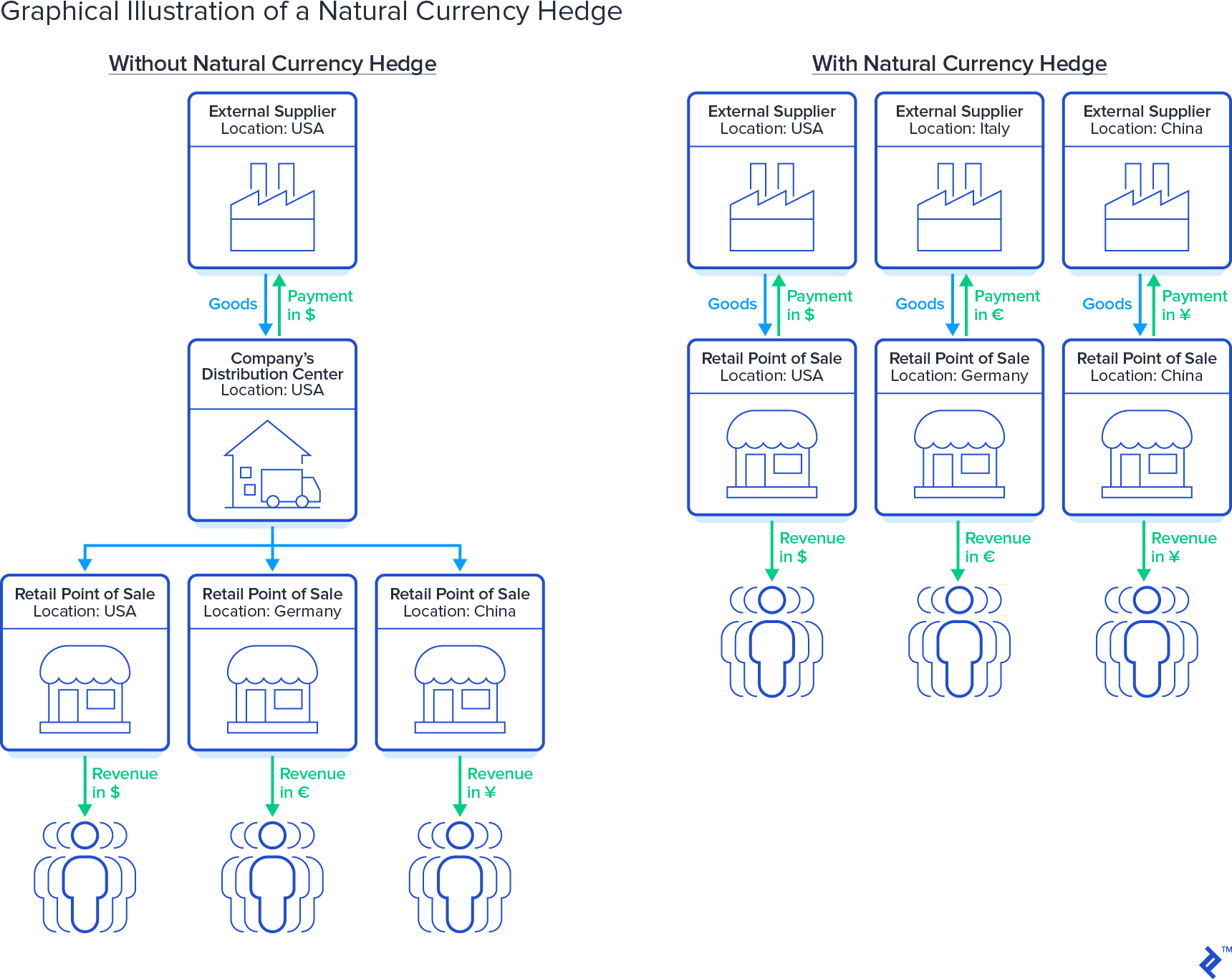

A natural hedge is when a company has a cost in a foreign currency, but also has some offsetting revenue in that currency, so those amounts are. Also known as hedging, this financial strategy. Line them up to look for any natural hedges.

Whether your small business keeps it. Assets and liabilities companies try to hedge against fluctuations in currency rates by locking in exchange rates to avoid an unexpected increase in their liabilities or debt. To reduce currency risk, u.s.

%20(002).png)